You usually have to fill out a number of documents with your own personal loan application

Loan providers evaluate numerous points when deciding whether to agree a consumer loan, including your credit rating, money, debt-to-earnings proportion and you may credit score. Nonetheless they want certain files, as well as your ID, proof target and records you to guarantee your income or any other economic activities.

If you’re considering a personal loan, it’s best to start because of the contrasting their borrowing from the bank condition and get together the desired data files to be sure you might be happy to use.

Unsecured loan files

:max_bytes(150000):strip_icc()/006_Apple_Cash-684ac1980dba4e4e9f3c182d25cd385c.jpg)

The very first is proof of label, and therefore should be a federal government-issued personality credit for example a driver’s license, birth certification, Personal Shelter card otherwise passport. Particular loan providers may require a couple kinds of ID.

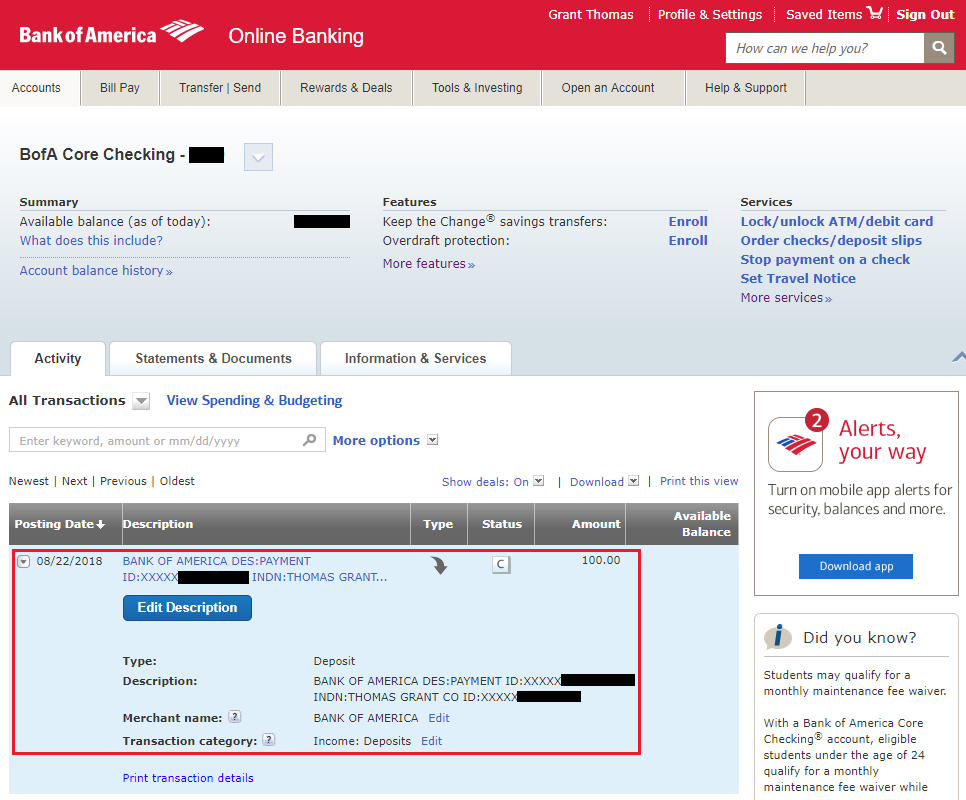

Be sure to demonstrate proof of target – a recent utility bill try a routine analogy, although a mortgage statement otherwise book deal you certainly will suffice – and you will proof of income (present spend stubs otherwise tax statements). The lending company age and you will contact number.

Their lender get request far more paperwork regarding the techniques, therefore it is important to respond to people demands timely to get rid of delays from inside the receiving your money.

Personal loan conditions

Loan providers have other conditions private loan things. Certain customize its products so you can borrowers having advanced level borrowing from the bank; anyone else offer financing to people with little credit rating.

Since the majority unsecured loans are unsecured (maybe not supported by equity), loan providers need certainly to very carefully feedback for each and every applicant’s creditworthiness. Most of the time, loan providers take a look at five items: credit score, earnings, debt-to-earnings ratio and fee records. Eligibility conditions are different by the bank.

step one. Credit rating

You want good FICO Get regarding Alabama loans good range (between 670 and you can 739) to get the really options from lenders. One may get financing that have a credit rating less than 670, however, loan providers constantly need compensating affairs, such as for example a higher income otherwise lower debt-to-earnings proportion. When you yourself have a reduced credit history, you are going to discovered loan has the benefit of with highest interest rates.

dos. Money

Of several lenders try not to divulge its money conditions, making it tough to give exactly how much you’ll want to create so you’re able to qualify for a loan. When the a loan provider do always reveal a full time income specifications, you need to be able to get all the details on its web site. Specific want only $fifteen,one hundred thousand annually, and others possess high minimums (instance $45,000). You will likely need promote documents such as for example pay stubs, W-2s otherwise present tax returns.

3. Debt-to-income ratio

Debt-to-earnings ratio, otherwise DTI, is computed by adding up all of your current month-to-month loans money and you can splitting the by your disgusting month-to-month income. As a whole, lenders like to see a beneficial DTI ratio from thirty-six% or all the way down. When you yourself have good DTI more than 36%, you will still could probably find financing option, although not – especially if your credit score and you may income was satisfactory.

An extended reputation for on-time payments is important to help you a lender. If you have paid your financial situation in the past, the lending company takes on it’s likely you’ll exercise in the future. Usually, fee history is related on credit score and you may statement. If you don’t have a long credit score, searching for loan providers you to focus on loans for these with little to no credit. Merely bear in mind they could need guarantee or charge large interest rates.

For folks who apply for financing during the a lender or borrowing from the bank union, it may take one five business days to get this new loans. Many online loan providers highlight faster recovery times and will put finance in as little as one working day after you are approved.

Acceptance hinges on the newest lender’s requirements plus borrowing get, money, DTI proportion and you can percentage records. Particular lenders disclose its acceptance pricing according to credit rating range, so you’re able to evaluate its websites for these facts. In most cases, for those who have excellent credit, good DTI out of 36% or lower and you can a steady money, your odds of acceptance are very higher, although loan amount you happen to be approved to own you certainly will are different from the financial.

Credit unions aren’t-for-money loan providers that are available so you’re able to serve the people, not shareholders. Ergo, borrowing from the bank unions may have a whole lot more self-reliance in the financing circumstances they promote. You can talk with financing mentor to describe your private situation and you can explore loan options the financing commitment possess having someone in your borrowing variety.

How much you be eligible for utilizes your earnings, credit score, the lender or other parameters. Lenders look at your month-to-month loans payments, such as automobile otherwise home loan repayments, to choose how much you can afford every month. Keep in mind that even though your qualify so you can obtain a quantity does not mean you have to pull out the full amount; you need to merely borrow what you want and can afford to pay-off.

Summary

If you were to think you can apply for a consumer loan about forseeable future, you’ll first need to make yes you might be ready to implement. Your next step should be to look loan providers.

Each bank have additional eligibility standards to have credit score, money, DTI proportion and you may percentage record. Pick lenders that enable you to rating pre-certification otherwise preapproval versus a difficult credit check. This task enables you to observe far you can use and at what pricing. Then you can start definitely evaluating loan providers.