Va Entitlement Calculator: How much Entitlement Carry out I have?

Also it can become exactly as tricky should this be your own second big date. Reusing Va entitlements boasts a great deal of questions regarding mortgage restrictions, how much entitlement you’ve got leftover, and more.

Then americash loans North La Junta, you assess just how much you have according to research by the county’s mortgage limit and you can circulate towards the purchasing the property you’ve always need.

Preciselywhat are First and you will Level 2 Virtual assistant Entitlements?

Thus giving their bank confidence so they can supply the Virtual assistant Mortgage that have zero downpayments and you can zero PMI. Plus it brings a unique chance to do have more than just 1 Virtual assistant Loan at the same time.

If you have never put entitlement just before and/or Institution away from Veterans Activities (VA) possess revived your own entitlement, you start with what’s titled Basic Entitlement. It’s $thirty six,000 to possess mortgage brokers less than $144,100000.

Experts and energetic-duty servicemembers be eligible for Tier dos Entitlement (often referred to as incentive entitlement) if you’re choosing a home more $144,100. This new Va claims $thirty six,one hundred thousand out-of Earliest Entitlement and you may twenty five% of county’s mortgage limit.

With her, each other forms of entitlement blend as your Complete Entitlement, providing you with more currency you’ll to purchase a house.

Calculating Their Remaining Va Entitlement

Figuring your own kept Va Entitlement you could do oneself or with a skilled bank. First, second Tier, and remaining entitlement data certainly are the common we see that have the house buyers i work at.

Very first Entitlement Computation

You’re getting $36,100000 inside the very first entitlement in the Virtual assistant if you find yourself loan amount are less than $144,000. New Certification out of Qualification (COE) informs if your stil hold Basic Entitlement or otherwise not.

There is seen people come across sweet home into the Tennessee and you will North carolina because price range and discovered financing in the eventuality of standard.

next Level Entitlement Computation

By using good Virtual assistant lender, you can need 25% of your county’s Va Mortgage Restriction and discover extent of entitlement after you have utilized the very first upwards.

A familiar scenario we have found in Washington try clients you to flow so you’re able to Maricopa County. Given that financing restriction was $647,two hundred, you’d be qualified to receive a second Tier Entitlement of $161,800.

Remaining Entitlement Calculation

You’ve got currently utilized the $thirty-six,one hundred thousand Earliest Entitlement and you will exactly what the Virtual assistant calls full entitlement but need it other possessions.

In these instances, an experienced financial walk you through a straightforward formula to assess the kept entitlement. They recommend back into the prior Va Loan and use it to possess studying brand new count.

You can also move to the latest Vanderberg Heavens Force Foot for the California due to a beneficial PSC, yet not have entitlement remaining.

Which have made use of all of your entitlement, the fresh new Va carry out simply take twenty-five% of one’s the latest county’s Virtual assistant Loan Limit ($783,150 when you look at the Santa Barbara) and you will subtract brand new entitlement you’ve used of it.

Va Lenders don’t require a deposit so long as you sit into the Earliest and you can next Tier Entitlement number. For people who go beyond, the lending company asks for money as a result of protect the funding.

You may want to make use of the Virtual assistant Mortgage to shop for a property which have a max amount borrowed that is equal to or below the rest entitlement.

We believe it’s your family members’ seek out live the newest Western Fantasy appreciate this great Nation you have forfeited getting. By the handling a talented Va Lender, they help you to get the most significant fuck for your Virtual assistant entitlement dollar.

Virtual assistant Loan Restrict because of the Condition

Brand new Va is an authorities company one knows both you and your mate is generally stationed otherwise retiring in the a expensive area of the nation, like California. It adjust Va Mortgage Restrictions depending on the cost of living of your own types of state.

You can aquire your ideal house with rely on knowing the Va deliver adequate. Remembering the army provider, the latest Dept. away from Pros Issues reward your with plenty of cash to reap that have a zero deposit home loan.

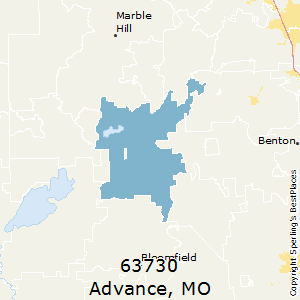

Take a look at the some other conforming loan restrictions per state. Most states have the basic Virtual assistant Financing Maximum of $647,200 and make it simple to help you determine your own second level entitlement.

Entitlement getting First-Go out or Knowledgeable Buyers

Va Entitlement is actually for people energetic-obligations solution representative otherwise experienced that is ready to find the house its family members’ constantly wished. Its the greatest time for you to pick a home close your route or to settle down near nearest and dearest on the last home.

I’ve a team of army-work on lenders that understand the procedure of to purchase a first or 2nd home with the fresh Va Loan. Our very own team is able to answer your concerns and you may stroll your from Va Financing Excursion step-by-action.

Contact us today within (480)-569-1363, therefore we normally honor you to suit your newest otherwise earlier army service to that Great Nation.