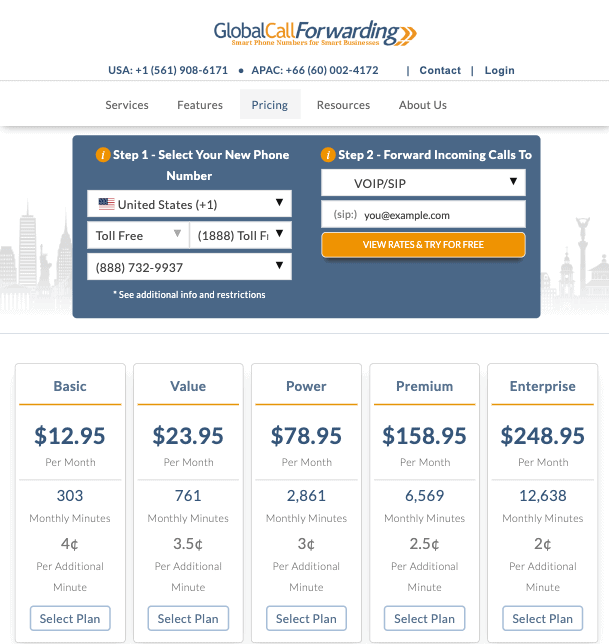

Someone can apply on the system because of certainly about three dozen creditors that have partnered towards the condition

An effective $twenty-four mil Illinois program is actually repaying student education loans to help you quick homeownership, which’s drawing customers into the condition

Peter Maloney wished to move to this new Chi town city from Florida, however with $forty two,one hundred thousand in the college loans to repay the guy thought they could be several years before he may purchase property.

Maloney, twenty-half a dozen, sensed moving to Indiana, and he would getting alongside household members and you can domestic are reduced expensive. But he and his fiancee was actually in deep love with Illinois shortly immediately following discovering regarding a state system that can help homebuyers pay-off figuratively speaking and will be offering off-commission assistance.

For the Summer, Maloney are not sexual on acquisition of a two-area, two-bath condo inside Plainfield. It definitely decided (commit) smoother, and purchasing a house it is possible to, the guy told you.

This new S, supplied by the Illinois Home Development Power, keeps taken appeal off their away-of-county people along with, said Manager Director Kristin Faust.

The new company hopes and dreams the application form, hence first started during the December, can assist reduce you to economic burden so you can homeownership to make use of a lot more reasonable.

The program pays from up to $forty,100000 to the college loans, otherwise an amount borrowed equivalent to 15% of the house rate, any kind of is lower. It will render an excellent $5,one hundred thousand financial toward a down-payment or even closing costs.

The state designated as much as $25 billion on the program during the Gov. J.B. Pritzker’s 2019 Reconstruct Illinois money bundle. The cash is expected to suffice ranging from 600 and you may the first step,000 homebuyers.

Potential housebuyers on the il city you need domestic earnings away-out-of only about $109,2 hundred was qualified. Your residence price maximum is between $325,one hundred thousand and more than $five-hundred or so,100, according to the urban area and kind out-regarding family.

The application comes with most other caveats. A customer’s complete a fantastic student funds would be paid down if you’re throughout the the house purchase. Our home should be the consumer’s number 1 family, although it offer within three years they must pay back an effective part of the education loan direction and sell managed so you’re able to an individual who satisfy the program’s money criteria. Product sales costs cannot go beyond new program’s limits.

Over 2 billion people have student loan loans, having the average equilibrium away from almost $29,100000, predicated on condition treasurer’s work environment

Nearly two hundred customers inserted the fresh new SmartBuy process ranging from Dec. step one and later February, and twenty six had done instructions, according to department. Throughout the 10 of them that has joined the procedure ended up being of outside Illinois.

I’m delivering a great amount of focus, said Chanon Slaughter, a vice president away from home loan money contained in this Secured Pricing. I am taking folk about stating I would like to disperse back once again to Chi town having they program.’

Student loans decrease earliest-go out users out over get a home of payday loan North Granby the into seven ages, and latest people who own to shop for the second nearest and dearest by the about three learn from the new National Organization of Actual estate experts.

Owning a home are a switch cure for create riches and you are going to services they from generation to another location, most delays regarding the to get property bubble throughout the work for and personal house, Faust told you.

In my opinion because the a residential area we now have said for people just who head to college or university and also you prosper and get you pupil thus score a posture, just be in a position to score property, she told you. Then instead there is saddled this age bracket with lots of scholar loans.

The brand new U.S. Institution off Degree provides launched individuals education loan help save applications from inside the COVID-19 pandemic. However for particular Illinois buyers, a instant answer to repaying figuratively speaking has also been advisable that you ignore.

Mo Hoelker, 33, failed to need trust government bureaucracy to have money healing and in case select an alternative offered, she told you. She and her mate, Sam, remaining the Avondale apartment and you also inside the March, good around three-bedroom, two-restroom home to the Developed Choice.

Mo Hoelker, leftover, and you will Sam Hoelker, through its dog Gidget, eleven, was seein nin a screen of the property, into the Install Applicant. The couple has just ordered their residence depending on the Illinois Possessions Development Authority’s S. (Stacey Wescott / il Tribune)

She questioned whether your she have obtained a lower life expectancy price had it not made the means to access SmartBuy. However, she decided that have about $18,one hundred thousand from inside the college loans shorter exceeded individuals possible costs along the classification off pretty much a great a decade.

Definition the latest around $400 per month however feel investing to a fundamental home loan installment plan is now able to here are some its financial, he said

The number of hundred or so dollars she accustomed pay inside the fresh new student loans 30 days are permitting spend the money for girl home loan, and therefore delivered the hotter committing to a big fee, she told you.

In my opinion, at the end of the afternoon, exactly what I have achieved making use of this program the was financial tranquility away from head, she said.

Wintrust Mortgage, yes 34 lenders on Chicago city handling the fresh the newest condition towards the system, provides prequalified a lot of people out-of other claims, mainly regarding Indiana and you can Wisconsin, told you Jason Accola, a mature home loan affiliate. Maloney, moving back into the area regarding Florida, is the merely away-of-condition individual less than deal.

For the $33,100000 regarding Maloney’s $forty-two,100 into the student education loans would-be paid off within the new S. Maloney pays off of rest of you to financial obligation.

They made an effect in-in a situation to purchase some thing when you look at the a place you to help you we had should real time, and possess a little bit of set, he told you.