Don’t neglect to pre-be considered in advance of in search of a property

If you are planning buying another type of domestic in the future, it is necessary on precisely how to lookup your house-to order budget in your full plans to own homeownership. Performing new mathematics and you may seeing just how your mortgage payment impacts your bucks will allow you to greatly. You have a far greater thought of what kind of household you can afford, and you can those is actually beyond your budget for the moment.

And here financing pre-qualification shall be a large help

A suitable property funds includes more than the purchase price away from a home. Additionally, you will have to think how much cash available getting a down-payment, and you will look into the most costs which you can need to keep inside notice. And, one domestic is introduce its manager which have an urgent resolve bill Montezuma loans while it is to own a leading-dollars items for example an air conditioning or plumbing work, you need to be prepared for it.

When you find yourself begin to believe you could utilize a little assistance with planning your home loan budget, contact us and get me to assist you with pre-qualifying to have a mortgage. This specific service exists free of charge and will offer you towards the numbers and assurance you want for a successful domestic hunting experience.

Just what financing pre-certification provides

At Quality, financing recognition procedure essentially begins with a casual meeting, or over the telephone when you’re also busy to get myself. You and your Financing Agent can look at the latest and you may upcoming earnings and you can any long-label debts you might be dealing with. Buying a duplicate of your own newest credit history is additionally region of the process.

Immediately following examining your earnings, expense and you may credit score, the loan Representative should be able to estimate the level of financing finance Caliber may provide. This step is called pre-certification.*

A good pre-qualification makes it possible to get ready for homeownership in lots of ways. Including which have a better look at the type of family you really can afford, you can save big date by the limiting your residence enjoying so you’re able to functions your are able to afford. Of course you happen to be prepared to make an offer, property supplier get enjoy the fact you’ve already over your house financing homework, and are usually dedicated to to get.

What is all of this in the obligations to money ratios?

Whenever people bank critiques a mortgage app, they consider several points that inform them more info on what you can do to settle the loan. To ensure the loan is actually affordable just today, but in the long run pose a question to your Quality Financing Consultant to help you determine their monthly financial obligation so you can Income ratios (usually abbreviated in order to DTI ratio).

One type of DTI proportion discusses their gross monthly money as well as how much complete month-to-month obligations you may be currently managing. Other DTI proportion adds a recommended month-to-month mortgage repayment on the month-to-month bills otherwise substitute a current leasing fee which have the next homeloan payment. These types of assist you in deciding simply how much away from financing you might easily do and helps end coming income difficulties.

An introduction to the many benefits of that loan pre-certification

- This will help to dictate the latest estimated mortgage loan matter which youre eligible, and you will what’s going to feel it really is reasonable.

- Specific Real estate agents or real estate agents can get encourage one has actually a good pre-qualification page at hand before you start to arrange appointments in order to evaluate land otherwise initiate planning unlock domestic incidents.

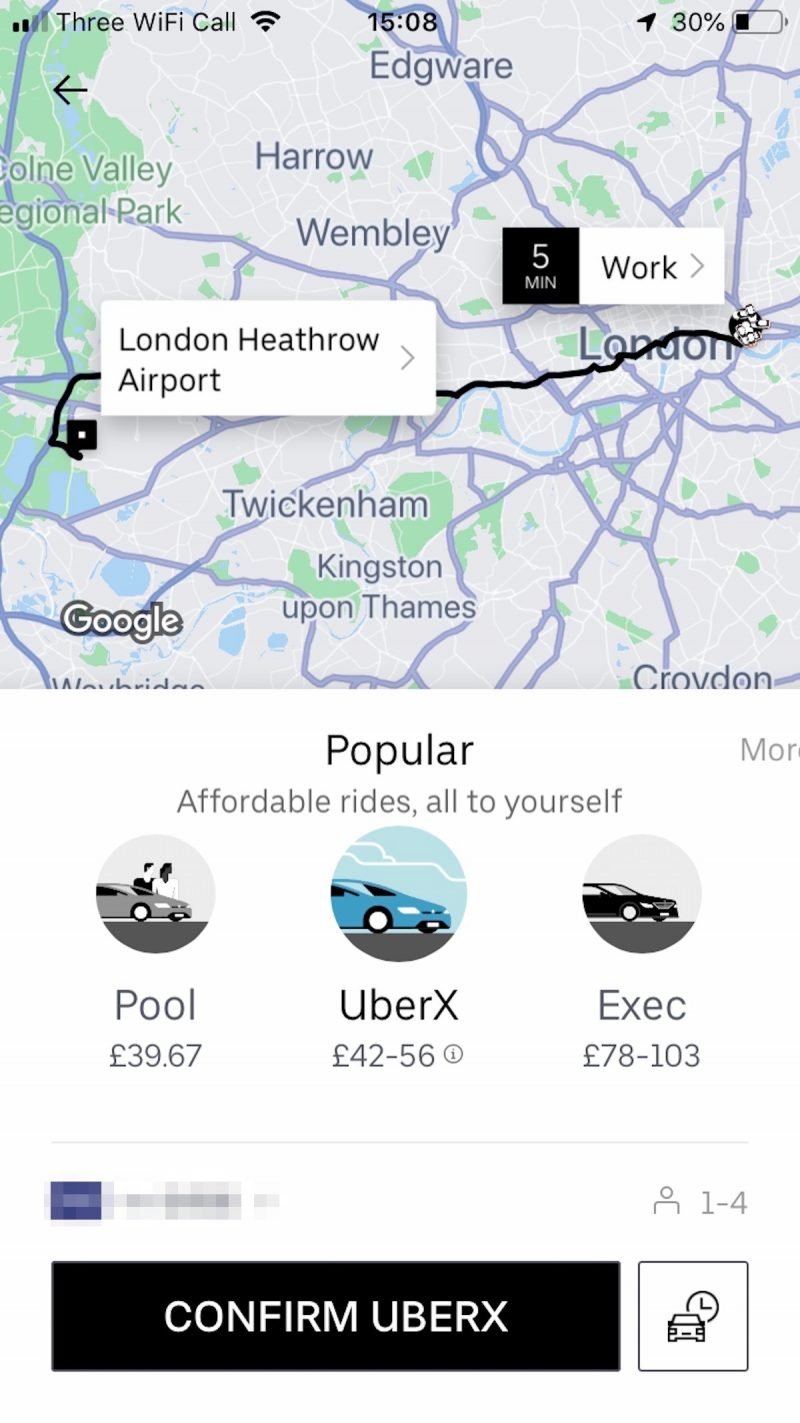

- It includes you with a projected monthly homeloan payment, to compare the prior to- and you will immediately after-purchase costs and determine exactly how homeownership commonly connect with your month-to-month dollars disperse.

- Getting pre-licensed may increase your probability of profitable a home bid or settling which have property supplier. It proves you have currently researched your financial budget with a specialist Loan Associate.

- It will help you eliminate worry, will set you back and you will date by the assisting you to get ready. While you can see away you can not a little manage a good home today, you will know what you need to do to reach finally your goal.

You’ll relish real assurance once you speak to a good Quality Mortgage Agent. The audience is willing to comment your earnings, assets, and borrowing to feel home loan-ready also to reply to your inquiries from inside the casual language. Let us make it easier to pre-be eligible for home financing now.

*A good pre-qualification isnt an acceptance out of borrowing and will not signify one to underwriting conditions had been fulfilled. Make sure to pose a question to your Caliber elite group your local area in the process, as one documentation you can even found uses some other terms.