As to the reasons your financial potential is generally slim with this specific mastercard

Credit cards gamble an integral part on your ability to meet the requirements to possess a mortgage. For those who carry a charge card on your own bag, this variety of credit card could be the good reason why your home loan it is likely that some time rugged. Here is what you have to know in the bank cards:

Really credit cards have a provision inside their borrowing contract one enables you to bring an equilibrium and you will paying rates of interest on that personal debt over the years considering an everyday occasional rates. The interest towards such as for instance notes is generally over eleven%. Credit cards operate in another way. Bank cards require you to pay-off the bill in full each month, requiring you to definitely be more in charge. This is an excellent matter as they require you to spend off the responsibility included in the card functions agreement.

Mortgages manufactured up against your revenue. Debt erodes money for a proportion regarding 2-to-step one. Per one dollar of personal debt you’ve got usually means a couple dollars of income that is required so you’re able to offset the debt. The majority of people fool around with credit cards to own general investing immediately after which pay it off entirely every month, others have fun with a credit card to possess big costs they’re able to spend off over time or problems and also have larger month to month balances. If you have a vintage bank card particularly a charge or Get a hold of card, such, therefore the harmony try $step one,000 percentage, their monthly payment with the that would be $70 monthly. Lenders dont examine exactly what your equilibrium was, they worry about exactly what the lowest commission is that you are obligated to spend monthly. Yes, it will be the commission owed at the conclusion of this new week, not the quantity due or how much you opt to shell out. This will be important since if you choose to pay more what is owed, well-done, you are economically in charge, but the bank is not going to leave you any accolades to have investing more than what exactly is due.

Fannie mae Freddie Mac computer sellers manage to responsibly ensure it is loans that otherwise cannot affect works efficiently

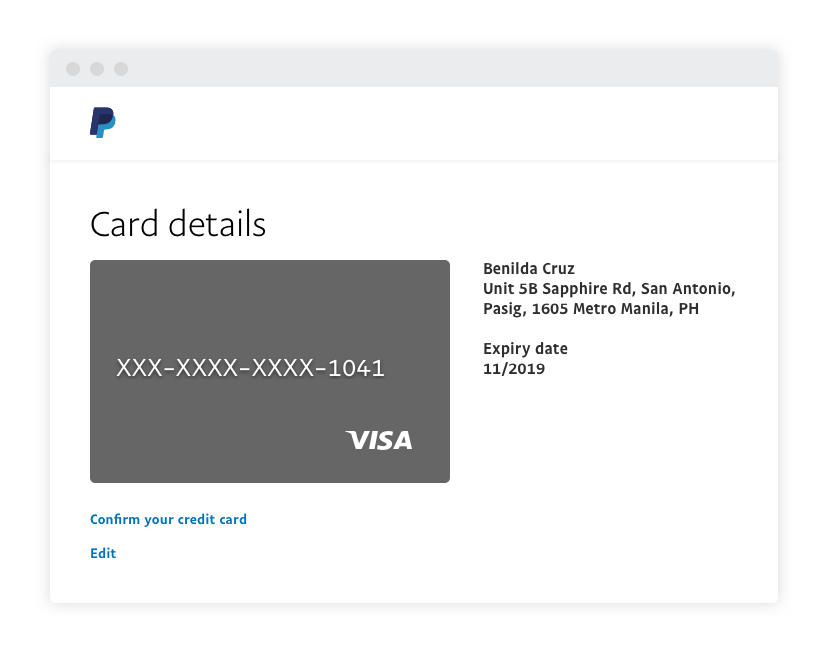

Let us declare that you may have a western Express credit card with an assistance agreement that needs one to pay it back in full monthly, akin to a credit card. If your equilibrium on your Western Express mastercard are $step loans in Wadley one,000, it does are accountable to the financing bureaus (and you can after that your financial) as if your lowest payment is actually $step one,000. Why its difficulty is the fact that the harmony in addition to percentage report comparable to each other. In this instance, the balance is equivalent to the minimum payment. Having a required payment off $1,000 usually strike the debt-to-earnings proportion sky-higher as the financial must utilize the complete equilibrium of your own American Show bank card.

Would be sure to consult with whoever you will be traveling which have

And here knowledge will get crucial when it comes time so you can get a home loan. $70 30 days to the a vintage credit card try a considerably much easier shape so you’re able to take into account if lender is wanting during the how much repayments you currently have for the link to an alternate advised property fee. The facts from it is the fact to prevent new debt obligations on your borrowing electricity, brand new Western Display charge card would have to be distributed regarding entirely because of the romantic off escrow. You are going to need to show the lender a statement appearing an excellent no harmony so you’re able to remove the obligations from your ratio. Remember that not all mortgage company can help you pay-off obligations in order to be considered.

The great thing to accomplish to put on your own throughout the top spot for qualifying having a home loan, if to order a property otherwise refinancing you to definitely you currently very own, is to make sure that for folks who hold a credit card the financial institution you choose provides you with the choice to spend that loans off before you intimate the loan. Once the a way of measuring a home loan considered, if you are planning to repay expense to be considered and you will improve your capacity to borrow on home financing, the way to do that and also the greatest bang for your buck would be to repay this new financial obligation that hold the highest minimum payment per month on the lowest possible balance. In that way you’re getting the most credit strength and maximum potential in exchange for a little resource.

If you are searching to acquire a home loan, ensure that the lender you are working with are good Fannie Mae and you will Freddie Mac provider and develop and additionally a good Ginny Mae financial. Correspondent lenders and brokers don’t have a lot of choice when it comes to what they can would as his or her apps have to be underwritten to have the masses.