What’s an effective Virtual assistant Certificate of Eligibility (COE) and how do I get that?

Experts Management (VA) mortgage brokers are a famous advantageous asset of armed forces solution. Here are a couple of things you must know throughout the Va funds.

What exactly is a beneficial Va financing?

It’s a kind of financial in which the Institution regarding Veterans Management (VA) guarantees your own hope to settle the lending company. Observe that the Va cannot point the loan. You have made they because of an exclusive bank and also the Virtual assistant guarantees it.

Virtual assistant fund wanted an initial, one-day fee titled good Virtual assistant funding percentage. The price usually can be included in the borrowed funds, just remember you are going to spend even more focus and have more substantial homeloan payment.

Having qualified to receive an effective Va financing?

Standards vary based on whether you’re a seasoned otherwise productive responsibility, whether your offered otherwise is actually serving on National Shield otherwise Put aside plus the point in time for which you offered. Right here specific standard direction:

- Latest energetic-duty participants qualify once 3 months out of persisted solution during wartime.

- Veterans which supported immediately after Aug. 2, 1990, meet the requirements whether they have 24 continuing days from active-duty services which have a discharge sorts of aside from dishonorable.

- Federal Protect players and you may reservists meet the criteria just after ninety days from active solution or half dozen several years of shield and put aside services.

Cadets within services academies, partners lower than unique affairs and those who offered in a few bodies groups are eligible. You can check full qualifications information, together with some other standards in the event you served just before Aug. 2, 1990, towards Va webpages.

The new COE verifies that you’ve met the service criteria had a need to rating a beneficial Virtual assistant mortgage. You want one every time you get a great Va mortgage. You will find a couple the way to get your:

- Apply on the internet through the VA’s eBenefits site.

- Pose a question to your financial if they can obtain it to you.

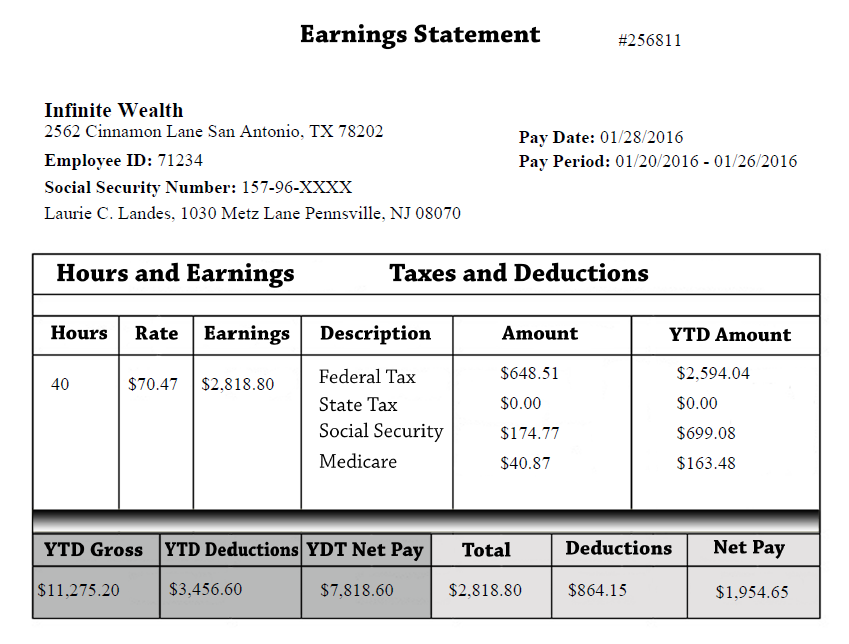

Will there be one monetary underwriting?

Yes. You’ll need to satisfy monetary guidelines set by the Virtual assistant and you can the financial. The lender look within such things as your credit score and records, assets, loan places Lake Pocotopaug and you may a job and income background. They may require also information about your most other costs, such as for example child-care will set you back.

Do i need to get an effective Va financial which have less than perfect credit?

The fresh Virtual assistant doesn’t require at least credit rating, but the majority Va loan lenders have a minimum needs. Speak to your lender to learn more. You will want to see where your borrowing from the bank really stands before you can look for property. Look at the credit report having errors and you may work at the financing bureaus to correct them. Their financial might require which you address collections and you can prior-due membership in advance of they agree the job.

What is the limitation Va amount borrowed?

Having individuals having complete entitlement, there is no restriction towards count the fresh Virtual assistant will guarantee. Simply be aware that your financial might require an advance payment in the event that your get more the brand new conforming loan restrict into condition the property is located in.

First, it ought to be the majority of your quarters – maybe not a vacation house otherwise money spent. Occupancy rules generally need you to move in inside 60 days off closing. You can find conditions, such as for instance when you yourself have Pcs purchases otherwise is implemented.

When it comes to version of domestic, it can be a current unmarried-family home, townhouse otherwise condo, otherwise the brand new build. Mobile and you can are designed land on the a permanent basis qualify, however the loan providers financing her or him.

The brand new Va have higher conditions to the updates of the property. It means you may have a difficult date playing with an excellent Va loan for a major maintenance endeavor. Structural, security and you may hygienic things listed by the appraiser always need end up being repaired prior to closure. Particular lenders s having residential property that require changes otherwise fixes.